Obsidian’s Purchase of Clearwater Assets for .5 Million

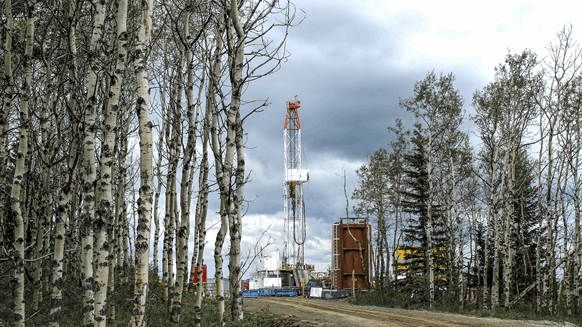

Obsidian Energy Ltd has announced the acquisition of approximately 1,700 barrels of oil per day (boepd) of Clearwater production and 148 net sections of land in the Peace River area from an undisclosed third-party vendor. The expected cost of this acquisition is around .52 million (CAD 76 million), which will be funded through debt financing. The transaction is expected to close by July 14.

Upon completion of the acquisition, Obsidian will have access to over 680 net sections of land with Clearwater and Bluesky heavy oil rights when combined with its other recent acquisitions. CEO Stephen Loukas highlighted the strategic value of this acquisition, emphasizing its synergistic nature with their existing Peace River land base and the potential for future growth.

The Peace River Peavine and Gift Lake acquisition is expected to provide additional production, reserves, and development potential along the Clearwater trend, building on the success of the Dawson field. With additional exploration and appraisal opportunities, Obsidian aims to optimize production and costs in the area while driving incremental growth in shareholder value.

The acquisition adds an average production of approximately 1,700 boepd, along with significant proved developed producing (PDP) reserves and proved plus probable (2P) reserves. Obsidian has adjusted its 2024 guidance, with production expected to average around 36,400 boepd. The company’s capital program for 2024 will focus on developing new and existing fields while further delineating its Peace River asset.

Overall, the acquisition strengthens Obsidian’s ability to meet its corporate growth objectives for 2024-2026 and enhances its position for future growth and value creation.