‘ETH Futures Open Interest Surges as ,000 Goal Nears’

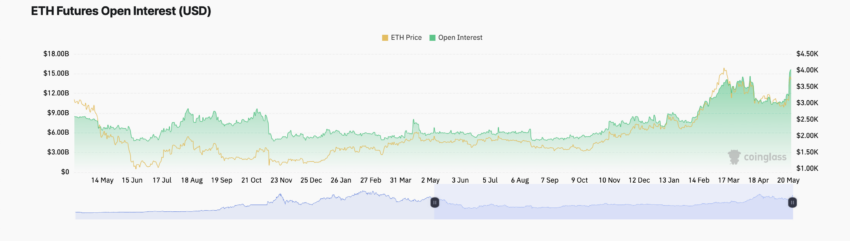

Ethereum’s futures open interest has surged to a record high of billion as the leading altcoin aims to break the ,000 price level and reach its all-time high of ,891 set three years ago.

The spike in open interest began on May 19 and has since climbed 45%, indicating a growing number of market participants entering new positions. Year-to-date, Ethereum’s open interest has seen a 69% increase.

Accompanying this rise is a positive funding rate of 0.014%, which reflects the periodic payment between traders in the futures market to maintain contract prices close to spot prices. A positive funding rate suggests higher demand for buying than selling, with traders in long positions paying those in short positions.

The combination of rising open interest and a positive funding rate points to significant bullish activity in Ethereum’s futures market, with more market participants opening new positions in anticipation of a rally.

Further supporting this bullish trend, Ethereum’s Relative Strength Index (RSI) is in an uptrend at 71.21, indicating a preference for accumulating ETH over selling. Additionally, the Chaikin Money Flow (CMF) is above its zero line at 0.22, signaling strong market strength and high capital inflow.

If the inflow of new capital into the Ethereum market continues, the coin may surpass the ,790 level and trade at ,838. However, if profit-taking occurs and bears re-emerge, the price could drop to ,633.

Overall, the data suggests a positive outlook for Ethereum’s price trajectory, with market participants showing confidence in the coin’s potential for further growth.